Manager Filled & Domestic Difficult Money Loans

There are many affairs and therefore end in a debtor are denied a domestic mortgage because of the financial institutions and you can borrowing from the bank unions, resulting in the debtor to show so you’re able to a residential difficult loan provider to get a difficult currency mortgage for their first residence:

- The brand new debtor currently has actually bad credit

- The fresh debtor has a recent foreclosures, bankruptcy, quick product sales otherwise loan modification

- New debtor keeps below couple of years out-of employment history having the newest employer

- New borrower is actually notice-working

- The newest borrower need a bridge mortgage to possess a primary household

- Brand new borrower try a foreign-national

Team Objective against. User Objective Tough Money Money

North Coastline Monetary might be able to bring tough currency fund for primary residences for both individual objective (tough money user fund) and you can non-user goal. Extremely tough currency lenders doesn’t imagine difficult money fund to possess an initial household. This is exactly primarily because an owner filled residential difficult currency mortgage:

- means even more files

- need more regulatory licensing

- was at the mercy of most rules

Organization Objective Tough Money Funds

A little bit of residential difficult money loan providers offer business objective holder occupied tough currency money. These money are possible whenever:

User Purpose Hard Currency Loans

Very few tough currency loan providers render individual mission proprietor filled finance (consumer difficult money loans). Financing could well be experienced consumer objective in case your financing continues were used to shop for an initial home. In the event that a cash-out home mortgage refinance loan was applied for towards an established dominating house for personal grounds such as remodeling a house, buying private activities, paying down playing cards and other expense the loan would-be noticed an arduous currency personal loan.

Authorities explain a customers mission loan as one where in actuality the proceeds can be used for private, family members otherwise home play with.

Qualifying to possess Proprietor Filled Difficult Money Funds

Residential difficult currency finance into the holder occupied house which happen to be user objective try at the mercy of government guidelines together with Dodd-Frank. This involves the lender to ensure the brand new borrower’s earnings and expense. Earnings confirmation is sometimes carried out by providing the financial that have pay stubs, W2s or taxation statements.

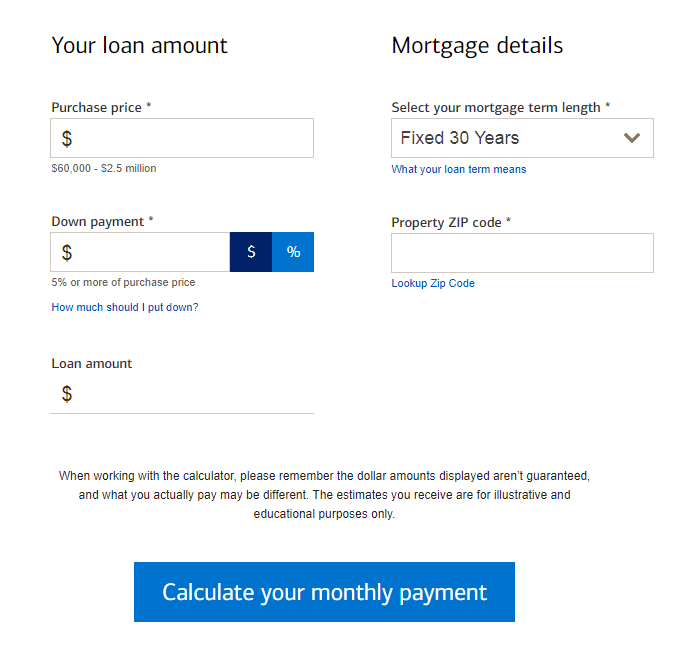

The fresh borrower is even required to remain their financial obligation so you’re able to money (DTI) around a particular ratio. The borrower’s current debts and additionally almost every other mortgages, auto repayments, bank card money or any other costs could be considered on the proportion while the the new proposed mortgage debt (mortgage repayment, taxes and insurance coverage).

Domestic Difficult Money Lenders

Home-based difficult currency lenders (to have resource or holder occupied qualities) promote loans that will be designed for small-label only use, fundamentally all in all, step three-4 many years. Particularly in the actual situation from a proprietor occupied borrower, residential difficult money loan providers require that the borrower has a reasonable package set up to get overall funding.

So it always comes to using the needed tips to repair credit in order in order to qualify for a normal loan otherwise postponing applying for a normal loan till the necessary wishing period immediately after a serious derogatory credit experiences such as for example a bankruptcy proceeding, brief purchases, property foreclosure or mortgage loan modification has gone by.

This new Federal national mortgage association lowest mandatory prepared period just after a beneficial pre-property foreclosure, bankruptcy proceeding or brief sale was once cuatro years. Minimal necessary waiting months for those occurrences has recently already been reduced so you’re able to couple of years.

Proprietor Occupied Tough Money Funds to have 2nds

If the a debtor currently provides a normal bank loan (1 st mortgage) on the possessions and contains sufficient collateral they’re able to to get a two nd loan up against their residence. Homeowners have a tendency to will remove a difficult money 2 nd up against their house when they cannot qualify for a good House Security Personal line of credit (HELOC) otherwise a property Equity Loan (HEL) but nevertheless must borrow against its property’s security.

Individual Currency Lenders for Domestic Holder Filled Possessions

Northern Coastline Economic is a personal loan provider to own domestic owner filled property based in Ca. The newest borrower must have good money and that is confirmed having tax returns, W2s otherwise shell out stubs. New borrower’s obligations in order to income ratio need remain at a fair into the newest proposed month-to-month financing payment to generally meet the modern federal statutes.

The fresh new debtor must provides an advance payment of at least 25-30%. A larger downpayment increase the possibilities of obtaining the financing acknowledged. Current fico scores have to be thought having private currency loans to possess a domestic proprietor occupied property. The credit scores should be at a consistent level which can be able to to be repaired and you may risen up to a point that can ensure it is the latest debtor to help you refinance to your a normal a lot of time-label loan in this step one-3 years.